“Homeowners will experience massive property tax increases in the coming years,” said Republican Assembly Speaker Robin Vos.

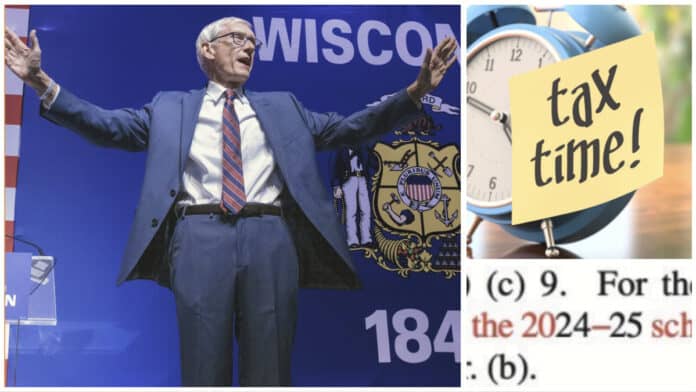

How bad are Gov. Tony Evers’ deceitful partial vetoes of the Republican-passed state budget? He screwed over Wisconsin property taxpayers for the next 402 years, unless a Republican governor is elected.

Evers eliminated a HYPHEN to allow school districts to add $325 per student every year for the next four centuries, unless a future Republican Legislature and governor undo it. He changed Republican wording referring to the 2023-24 and 2024-25 school years by vetoing a hyphen and the number “20” to change the passage to the year 2425. That’s undemocratic; it goes against both the legislative intent and the will of the voters.

Evers also eliminated tax cuts on all married Wisconsinites for taxable income of between $36,840 and $405,550 per year and for single filers’ earnings of more than $27,630, even while dishonestly pretending he’s standing up for the middle class and the working poor. Unbelievably, Evers actually wrote this line in his press release, “Gov. Evers’ vetoes ensure that tax relief in the 2023-25 budget goes to working families who need help affording rising costs.”

State Rep. Chanz Green wrote, “Those making over $28,000 will see very minimal tax relief. To put things in perspective, 95% of the legislature’s income tax cut was vetoed by a governor who says he wants to help the middle class.”

In the GOP plan, taxpayers would pay a 4.4% rate on income between $36,851 and $405,550 for married filers. Under Evers’ tax rates, that will be 5.3%. Those with taxable income over $405,550 would pay a 6.5% rate under the GOP plan but 7.65% under Evers.

“With his veto message today, Governor Evers said, ‘F*** the taxpayers, they don’t know a G** d*** thing about spending their own money. These vetoes aren’t the work of a rational governor. They are the conscious decisions of a radical governor. Governor Evers decided that no taxpayer deserves more than $37 in tax relief… He unilaterally chose to set school funding for the next 402 years, no matter the impact on property taxpayers,” wrote Van H. Wanggaard, a Republican state Senator.

Voters have already eliminated the so-called “Vanna White” and “Frankenstein” vetoes, which gave governors the power to create new meaning by eliminating letters or creating new sentences by eliminating words. Evers created new meaning by eliminating a hyphen and numbers anyway; that’s deceitful.

.@Tony4WI used his veto power to increase Wisconsin homeowners property taxes for the next 4 centuries. Pass it on.

— Wisconsin GOP (@WisGOP) July 5, 2023

“By allowing this level into the future, homeowners will experience massive property tax increases in the coming years,” Republican Assembly Speaker Robin Vos said in a statement.

“I think what the Governor did today is inconsistent with the opinion of four justices in Bartlett v. Evers,” tweeted Rick Esenberg, of the Wisconsin Institute of Law and Liberty. “Just as importantly, it’s acting in bad faith. No one thinks a law should set revenue limits for 402 years. He did this for a small advantage. He should be ashamed.”

I think what the Governor did today is inconsistent with the opinion of four justices in Bartlett v. Evers. Just as importantly, it's acting in bad faith. No one thinks a law should set revenue limits for 402 years. He did this for a small advantage. He should be ashamed. https://t.co/SV5K5ePpS6

— Rick Esenberg (@RickEsenberg) July 5, 2023

Furthermore, ignore all of the media narratives about legislative Republicans supposedly wanting tax cuts for the wealthy as Evers positions as some crusader for the working poor and middle class.

“And to clarify, ‘scales back’ means cuts 95% of the tax cut ($3.3B), including those truly middle-class earners that have been hit especially hard by record-high inflation,” tweeted Republican Rep. Mark Born.

Insanely, state Democratic Rep. Deb Andraca claimed on Twitter that Evers’ actions reflected the “will of the people.” On what planet would most Wisconsinites not desire to have a significant tax cut right now?

$37

That’s how much of the $7 BILLION surplus @govevers thinks you deserve.

Not enough for a tank of gas. pic.twitter.com/lqOSV1rNg8

— Van Wanggaard (@Vanwanggaard) July 5, 2023

Republican state Rep. Barb Dittrich wrote, “Unfortunately, Gov. Evers revealed himself to be dishonest in his negotiations with his line-item vetoes of our budget. He wasted more of Wisconsinites’ hard-earned dollars by finding ways to restore funding of gender transition surgery via Medicaid and restoring 188 DEI positions in the UW System.”

She added: “He refused tax-cuts to 69% of Wisconsinites, returning only $175 million of the $6.9 billion surplus, or .0025% of that surplus to taxpayers. Additionally, he was disingenuous on school funding, and created an environment hostile to Wisconsin homeowners by increasing property taxes, writing in a public school funding increase each year for the next 402 years.”

The Republican tax plan had compressed the four income tax brackets to three and reduced rates for all taxpayers.

Or, as @BadgerInstitute and @TaxFoundation put it last year, Wisconsin's top rate is higher than any state between New York and California but for one. https://t.co/Pz2tc0j9e4 https://t.co/FhPplI4LEI pic.twitter.com/36AJpxK9GS

— Patrick McIlheran (@PaddyMacMke) July 5, 2023

Where we come from, a person making more than $26,000 is not the “rich,” although we don’t support penalizing success, either. With states like Illinois and Minnesota so off the rails that Wisconsin had the chance to look competitive, Evers tanked it all because he, presumably, doesn’t want to give Robin Vos a victory.

“Last year Governor Evers campaigned on Republican tax cuts; now that he’s been re-elected, he shows his true colors,” Sen. Patrick Testin, R-Stevens Point, said Wednesday. “The Governor’s partial veto of the legislature’s tax cut hurts taxpayers, hinders Wisconsin’s ability to attract new talent, and stifles our potential for growth. Evers politically motivated actions will have real life consequences for our future.”

Evers would rather screw over almost every hard-working Wisconsinite at the very time that people are struggling with inflationary increases at the grocery store. Thanks, Tony. He did prioritize preserving positions for diversity, equity and inclusion in the UW System, though.

Evers on Wednesday signed a new two-year $99 billion state budget. Evers slashed Republicans’ income tax cut from $4.5 billion to $800 million.

The media have deceptively informed people that Evers eliminated tax cuts for the “top two tax brackets” in Wisconsin, making many people falsely think that applies only to the wealthy.

Here’s an example. Ruth Conniff is a liberal journalist with the Wisconsin Examiner, which pretends to be non-partisan. She tweeted, “Wisconsin Republicans are breaking Twitter with their temper tantrum over Evers’ partial vetoes of their budget — especially those big tax cuts for the top earners in the state.”

The part she left out: The second highest tax bracket reaches way down into the working poor.

The Republican plan was written to cut Wisconsin’s top income tax rate of 7.65% to 6.5%, which would have meant a 15% tax break for married couples making over $405,550 a year. The same married couple making between $36,840 and $405,550 would see their income tax rate go from 5.3% to 4.4%, which is a 17% tax cut.

The governor called those tax adjustments “cuts for millionaires.”

Sen. Julian Bradley, R-Franklin, tweeted: “During a time of record inflation, Gov. Evers included tax increases in his budget proposal. Today, he vetoed BILLIONS in tax relief from the budget GOP Lawmakers passed. He believes the government can spend your money better than you can. He’s wrong.”

Evers did not veto the $32 million shift in the University of Wisconsin’s budget aimed at defunding diversity, equity, and inclusion efforts in the UW System. But the governor used a partial veto to protect the nearly 200 jobs that lawmakers wanted to eliminate.

-Center Square contributed to this report.