A trio of Wisconsin Republican lawmakers are again pitching a tax-free retirement plan that would exempt $75,000 of retirement income for single filers and $125,000 for married joint filers.

The 2025 legislation was pitched and passed earlier this year that was ultimately vetoed by Gov. Tony Evers.

This time, the legislation will be in addition to any retirement income that is already tax-exempt in Wisconsin, such as Social Security. Thirteen other states, including Illinois and Iowa, have tax-free retirement laws.

“We can’t afford to keep losing seniors to other states,” said Rep. Joel Kitchens, R-Sturgeon Bay. “When they leave, we don’t just lose revenue. Families miss out on sharing important life events. Wisconsin is sitting on a $3 billion surplus, we can afford this tax cut more than we can afford not doing it.”

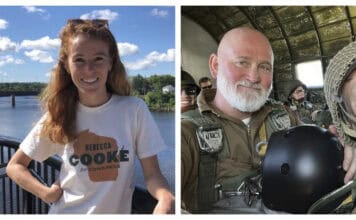

The legislation will be sponsored again by Kitchens, Rep. David Steffen, R-Howard, and Sen. Rachel Cabral-Guevara, R-Fox Crossing.

“Our retired parents and grandparents deserve to keep the money they’ve put away throughout their career,” Cabral-Guevara said in a statement. “Punishing them for staying near their family in Wisconsin once they retire isn’t the way to treat our seniors. As I’ve repeatedly said in the past, I trust Wisconsinites to spend their money more wisely than the government.”