Letter to Editor from Some Members of the Waukesha County Budget Task Force To the Citizens of Waukesha County

We, the signatories to this letter, were invited to serve on the Waukesha County Budget Task Force to represent the interests of the public and business community. The task force was intended to gather public input and guide future county budgets.

The task force was informative and assisted in our understanding of the County’s long-term fiscal challenges, which have resulted from the impacts of inflation and the limitations in place on property tax increases. We applaud County Executive Farrow for convening the task force and highlighting the many prudent actions that the County has conducted to streamline government. We appreciate his overall stewardship of our tax dollars over his tenure.

After several meetings reviewing the issue and potential solutions, the Task Force failed to make a final recommendation on how to resolve the County’s long-term fiscal needs. County Executive Farrow indicated that he could solve the current budget gap without a sales tax increase, which relieved the need for the Task Force to make an immediate recommendation.

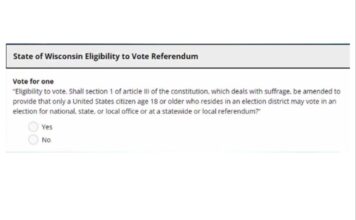

As far as the long-term fiscal gap, no solution was recommended. Most members on the tax force felt that the best solution to the issue is indeed a sales tax because it would have the least burden on Waukesha County taxpayers. However, the signatories to this letter expressed a concern that the sales tax would generate much more revenue than is needed to solve the county’s projected budget gap. We believed that the “Waukesha County Way” is to only tax what is needed, and that a full .5% sales was quite simply over taxation. We asked for the opportunity to work with County in the next legislative session to seek flexibility to adopt less than a .5% sales tax. We believe that asking to be allowed to tax for less than what is allowed should be a refreshing message to the legislature and Governor Evers.

To our surprise, two weeks after the introduction of the County Budget, an ordinance was introduced to implement a full .5% sales tax in Waukesha County without allowing the opportunity for the business community to have conversations with our legislators about our alternative sales tax proposal. To make matters worse, the ordinance was fast-tracked with an introduction and proposed passage within a few weeks. This type of urgent action to pass something quickly is all too common in the Federal Government. Is this approach that we want as residents and businesses in Waukesha County on a potential $60 million annual tax increase? Is this the “Waukesha County Way”? We would expect more opportunities for our residents and businesses to be able to voice their opinions on such an important issue.

Unfortunately, we feel it is now necessary to raise our objections to the speed of adoption and the selection of a solution that overtaxes without the full opportunity to pursue a solution that is right-sized to the problem. We believe that all Waukesha County residents should oppose this proposal and to ask their County Supervisors to work with the business community on a narrowly tailored solution to generate only enough revenue to address the need.

We are ready and willing to assist on a better approach, one that is specifically designed to address the concerns of our residents and businesses, one that reflects the “Waukesha County Way”.

Sincerely,

Matt Moroney

Jeff Hoffman

Tom Schreibel

John Siepmann

Jeff Searl

Stan Sugden

Bonnie Lee

![Why a Vote for Trump Makes Sense [WRN VOICES] trump debates harris](https://www.wisconsinrightnow.com/wp-content/uploads/2024/09/trump-debates-harris-356x220.jpg)