“For an average Wisconsin home valued at $300,000, property taxes could increase by $624 or more annually if the costs were shifted to taxpayers” – WILL

The Wisconsin Institute for Law & Liberty (WILL) has released a new property tax calculator “to help Wisconsinites estimate the significant financial impact that repealing Act 10—major collective bargaining reforms passed in 2011—could have on their personal finances.”

You can find the calculator here.

This is no hypothetical; it’s widely believed that a liberal court will overturn Act 10 if Dane County Judge Susan Crawford wins a seat on the state Supreme Court this April. That’s because, as a private lawyer, Crawford filed a lawsuit seeking to overturn Act 10. She is running against former Republican Attorney General Brad Schimel, who is a Waukesha County Judge and former District Attorney.

In a press release, Schimel has noted that Crawford has refused to say she would recuse herself on Act 10, if elected. “Susan Crawford’s failed attempt to overturn Act 10, coupled with her well-documented disdain of the law, raises serious judicial ethics questions,” he wrote.

Act 10 Property Tax Calculator

“This free, easy-to-use tool allows individuals to input their school district and property value, providing them with an estimated increase in property taxes if Act 10 were repealed. While this doesn’t capture the total cost of repealing Act 10, it is a reasonable estimation,” WILL wrote.

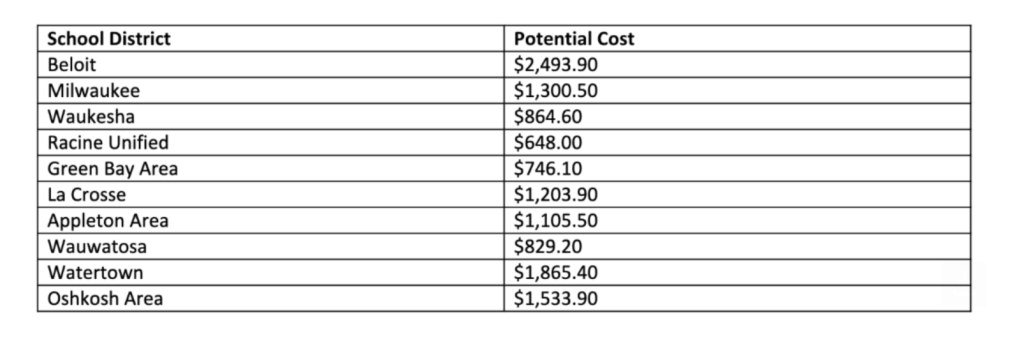

WILL noted that potential increases “can range greatly between districts. The chart below shows the potential tax increases on a $300,000 home for a variety of school districts around the state.”

WILL Research Director, Will Flanders, “Act 10 has been a win for Wisconsin taxpayers, slowing the growth of government and the constant threat of massive property tax hikes. Without it, taxpayers could be on the hook for billions in tax increases in the coming years. School districts and local governments could once again be pressured to cater to public-sector union demands, leaving hardworking taxpayers to shoulder the burden of skyrocketing costs.”

WILL noted, “As Wisconsin courts consider the future of Act 10, WILL’s previous research has shown that repealing Act 10 could cost taxpayers over $2 billion each year, including:

$1.6 billion annually in new costs for school districts

$480 million annually in new costs for local governments.”

“While the prior research focused on the statewide impacts, this new analysis is even more relevant to individual Wisconsinites because it allows them to estimate how much their own property taxes would increase should the law be repealed,” wrote WILL.

“Statewide we estimate that school districts could face $1.788 billion annually in new costs if Act 10 were repealed. This largely aligns with WILL’s previous estimate of $1.6 billion in additional annual costs to school districts,” WILL wrote.

Table of Contents