Critics say the federal funds are a true bailout because the federal funds are not requiring any major reforms from the unions. The funds are also only enough to delay the insolvency of a fraction of the funds, critics say, and not fix the problem.

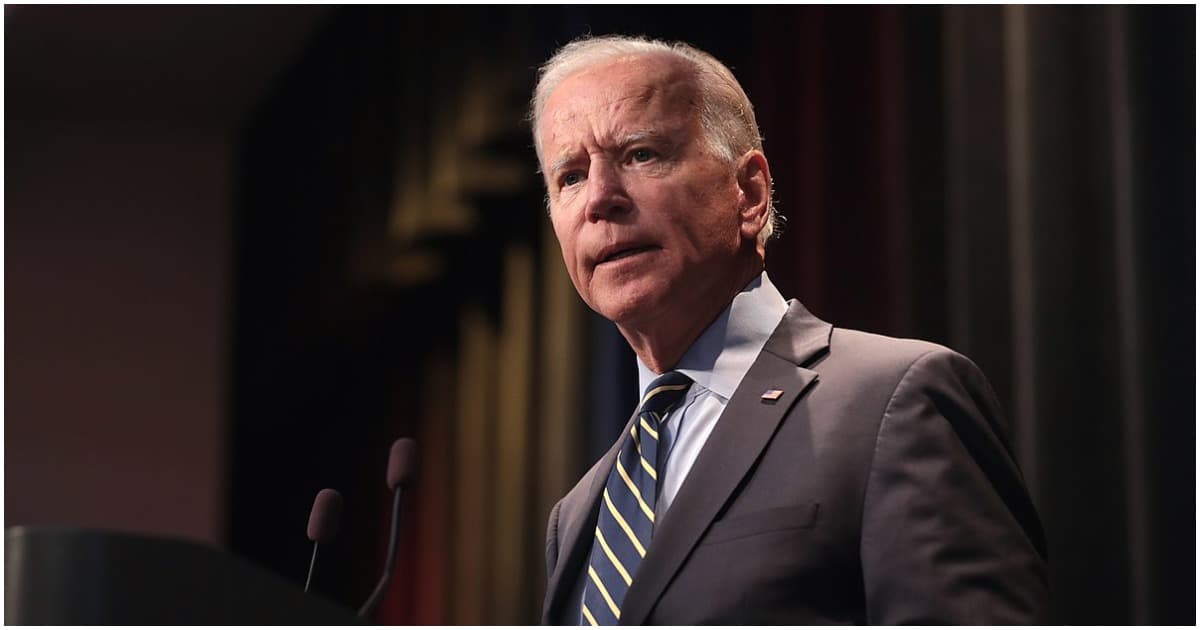

President Joe Biden on Wednesday touted a federal program to delay insolvency for private unions’ pension funds, but critics say taxpayer dollars should not be used to “bail out” pensions negotiated by unions.

Biden called the plan “historic.”

Biden spoke in Cleveland, Ohio, about the American Rescue Plan’s Special Financial Assistance program, which will protect more than 10 million Americans in multi-employer plans from seeing their benefits slashed when their plan becomes insolvent, which many are projected to do in the next few years.

“This was $90 billion, O.K.?” Biden said in his remarks. “But it is small in comparison to the bailouts of businesses and major corporations and banks…”

Multi-employer pensions are those negotiated across an entire industry, like mining or construction, with private unions and employers running the plans. The Biden administration announced a final rule this week regarding the rates of return and kinds of investments these pensions can utilize.

“The backbone of the country are the working women and men, the middle class, and you know there’s a middle class for one reason: American unions,” Biden said.

Critics, though, say it will be regular Americans who foot the bill.

“[Biden] is saving private union pensions by making ordinary Americans pay for them,” said Rachel Greszler, an expert at the Heritage Foundation. “And 6% of private sector workers are unionized so many of the blue collar workers that aren’t part of a union, or maybe they are part of a union that no longer has a pension plan, they are the ones who are going to bear the burden.”

Democrats praised Biden’s decision, saying it will help millions of Americans keep their benefits.

“Today’s action by the Biden-Harris Administration establishes the final rules for the multi-employer pension rescue program that will protect millions of Americans’ retirement security and save tens of thousands of businesses,” said U.S. Rep. Robert C. “Bobby” Scott, D-Va., who chairs the House Committee on Education and Labor. “For years, workers, retirees, businesses, and taxpayers sought a solution to the multi-employer pension crisis. In response, Congressional Democrats delivered a historic victory through the American Rescue Plan that keeps the promises made to retirees, saves businesses from going under, and shields taxpayers from the even greater cost of a multi-employer pension collapse.”

When some employers who originally were in the pension negotiations went out of business, their unfunded pension liabilities remained and were absorbed by other employers, worsening the problem.

“[Unions] have consistently promised more than they have set aside to pay,” Greszler said. “The incentives are all wrong here because the union can say to their members, ‘see we got you a higher pension benefit. We weren’t able to get you increased wages, but we were able to get you the pension benefit,’ and they can tell the employer, ‘we know you can’t afford higher wages, and we are not going to have you contribute more to the pension. We are just going to tweak our interest rate assumptions so that we can promise more but you don’t have to pay anything more.’

“So that’s the problem, that historically they have assumed very high rates of return like 8% where all financial economists will say if you have a guaranteed benefit like a pension, you should be using a riskless rate of return or at best a conservative bond rate. … instead they used stock market rates that translate into being able to make good on your promises only 50% of the time, and when their returns fell short, plans consistently failed to make adjustments,” she said. “The promises were decades into the future, so they got away with it until recently when plans started failing and the entire system is on track to pay only 42 cents on the dollar in promised benefits.”

Critics also say the federal funds are a true bailout because the federal funds are not requiring any major reforms from the unions. The funds are also only enough to delay the insolvency of a fraction of the funds, critics say, and not fix the problem.

“It actually makes it worse because it creates incentives in the short term for plans to promise more and to make worse assumptions than they already were so they can qualify under this short window to get bailouts, and there are no consequences going forward,” Greszler said. “And now that the federal government established that we are going to bail out these plans, plan administrators know that the sooner their plans become insolvent, the higher the likelihood they have of getting that bailout.”

Casey Harper

Go to Source

Reposted with permission

![Governor Caught Playing Politics with Brillion Residents’ Lives & Livelihood [COLUMN] ron tusler](https://www.wisconsinrightnow.com/wp-content/uploads/2025/07/MixCollage-15-Jul-2025-03-35-PM-9568-265x198.jpg)

![Protecting Portland: No Good Deed Goes Unpunished [REVIEW]](https://www.wisconsinrightnow.com/wp-content/uploads/2025/07/portland-265x198.jpg)