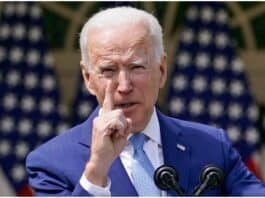

(The Center Square) – Democratic presidential candidate Joe Biden’s proposed tax increases of nearly $4 trillion over the next 10 years, if passed, “would be the highest in American history – indeed, in world history,” an analysis of his plan determined.

Lew Uhler, founder and chairman of the National Tax Limitation Committee and National Tax Limitation Foundation (NTLF), and Peter Ferrara a senior policy adviser to NTLF, made that conclusion in a new report published by The Hill.

A separate analysis by the nonprofit, nonpartisan, Washington, D.C.-based Tax Foundation found that Biden’s tax plan would reduce the economy’s size by 1.47 percent in the long run. It would also shrink capital stock by just over 2.5 percent and reduce the overall wage rate by a little over 1 percent, resulting in a loss of 518,000 full-time jobs.

Biden’s tax plan would raise roughly $3.05 trillion over the next decade on a conventional basis, and $2.65 trillion after accounting for the reduction in the size of the U.S. economy, the analysis found.

His plan would raise taxes on labor income, investment income, business income and raise the capital gains tax to 40 percent, doubling the existing rate.

Biden’s plan also would fully repeal the 2017 Tax Cuts and Jobs Act components for high-income filers, impose a 12.4 percent Social Security payroll tax for wages above $400,000, increase the corporate income tax to 28 percent, establish a corporate minimum tax on corporate book income, and double the tax rate on GILTI (Global Intangible Low-Taxed Income) and impose it country-by-country.

By repealing the TCJA, a hallmark of the Trump administration, Uhler and Ferrara argue Biden would be raising taxes on the middle class, blue-collar families and American corporations no matter how large or small they were.

“Such tax increases would return America’s corporate tax rate to close to 40 percent, the highest in the world,” they argue.

“Biden’s tax increases would raise taxes on middle-class families by over $2,000 a year, with a $1,300 annual tax increase on a median-income, single parent with one child,” Uhler and Ferrara, estimate. Repealing President Donald Trump’s tax reform would also cut in half the child tax credit and standard deduction, which currently help lower-income families the most, they add.

But according to a Penn Wharton model produced by the University of Pennsylvania, Biden’s tax plan would raise $3.375 trillion in additional tax revenue from 2021 to 2030 and the richest taxpayers would pay roughly 80 percent of the additional taxes collected.

The Tax Foundation projects that on a conventional basis, the Biden tax plan by 2030 would lead to about 6.5 percent less after-tax income for the top 1 percent of taxpayers and about a 1.7 percent decline in after-tax income for all taxpayers on average.

By Bethany Blankley | The Center Square

Go to Source

Reposted with permission