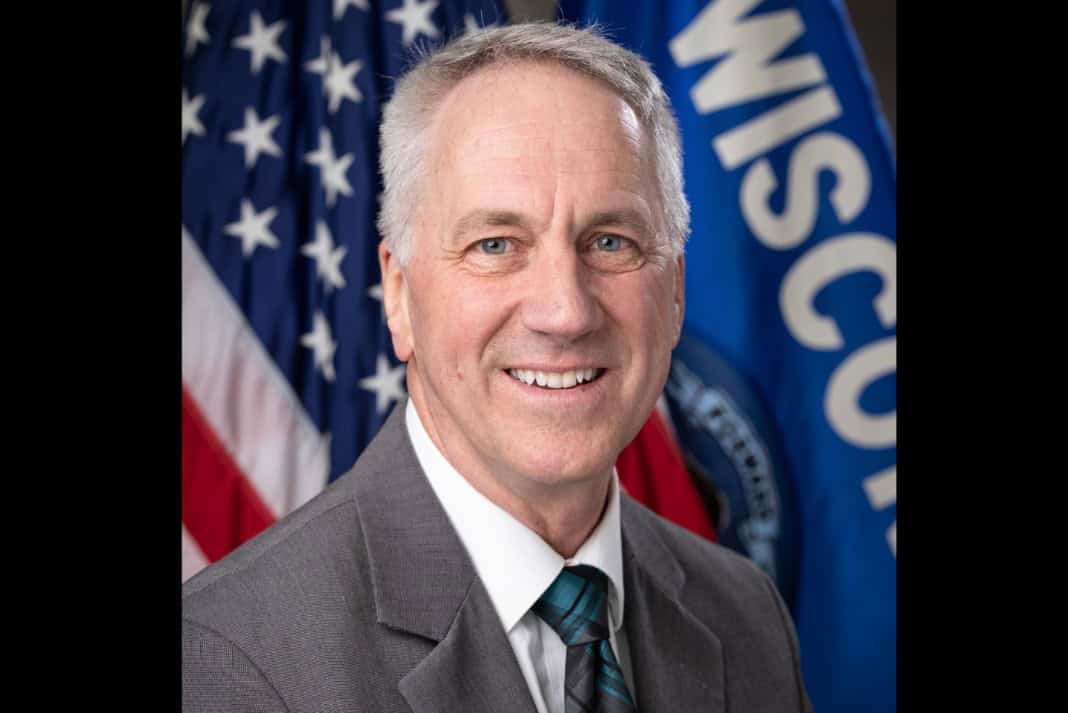

For taxpayers, it has been a symbolically momentous week. Tax Day arrived as usual on April 15th, and Tax Freedom Day arrived three days later, symbolizing the day when Americans finally earn enough to pay off their total tax bill for the year. This year, taxpayers spend 109 days working solely to support the government’s spending, before finally earning for themselves. In Wisconsin, Tax Freedom Day could have arrived a little sooner, but did not courtesy of Governor Tony Evers’ repeated vetoes of the Republican-led tax reform packages that have arrived at his desk this session.

Three times now just this legislative session, Governor Evers has vetoed tax relief packages sent to his desk, denying Wisconsinites their own hard-earned dollars despite a multi-billion dollar surplus, at a time when taxpayers across the state are feeling the strain of economic uncertainties.

Let’s review exactly what the governor denied Wisconsin taxpayers (in other words, you). Most recently, he vetoed a package of bills that would have helped every single taxpayer in the state. That included making retirement income for most retirees tax-free and increasing the married persons tax credit. It also included an income tax cut, primarily targeted at the middle class, which would have saved the average filer $772.

At a time when our neighbors in Michigan, Indiana, Iowa, and yes, even Illinois, are making their income tax rates flatter and more competitive, our governor should be joining the legislature in making Wisconsin the best place in the region to live and work, whether you are a small business, young professional, or retiree. Instead, he has chosen to withhold the surplus and deny taxpayers much-needed relief.

Our state is blessed with a multi-billion dollar surplus. This week, the Wisconsin Policy Forum released a report showing that Wisconsin’s finances are the strongest on record. Our debt is low and we have a surplus with ample cash reserves to cover our obligations. This is in spite of massive increases in school funding, roads, and aid to local governments in the last budget.

Ironically, much of the reason why we are in such a strong fiscal position is because we have spent the past decade cutting taxes. Prudent, forward-thinking budgeting by the legislature has grown state tax collections over the past decade, despite cutting over $20 billion in taxes during that time. As taxpayers reinvested their savings, the economy has grown and the new economic activity has generated new tax revenues. With a massive surplus resulting from these efforts, now is not the time to change course and return to the disastrous tax policies that once made Wisconsin one of the least attractive states in the nation for business.

![WATCH: Elon Musk Town Hall Rally in Green Bay [FULL Video]](https://www.wisconsinrightnow.com/wp-content/uploads/2022/04/Elon_Musk_3018710552-265x198.jpg)