This is an opinion piece.

The Fed has been busy selecting their pronouns for their emails (literally – I’m not making this us – it was told to me from a Fed Governor) and other such nonsense while the economy teeters on the edge…due to their overly high interest rates.

This Fed, under Powell’s leadership, has virtually been wrong on every single Fed move; always too late to loosen, too late to tighten, and whipsawing the economy up and down at their own whim.

If I was Fed Chairman, what would I do differently?

First, I would change the Fed over to the decimal system, which would allow for smaller changes in interest rates, signally direction earlier without the big (late) jumps the Fed has made in the past. With the decimal system, the Fed could change rates by 5 or 10 basis points instead of a minimum of 25 basis points so rate changes could begin sooner with no harm or risk.

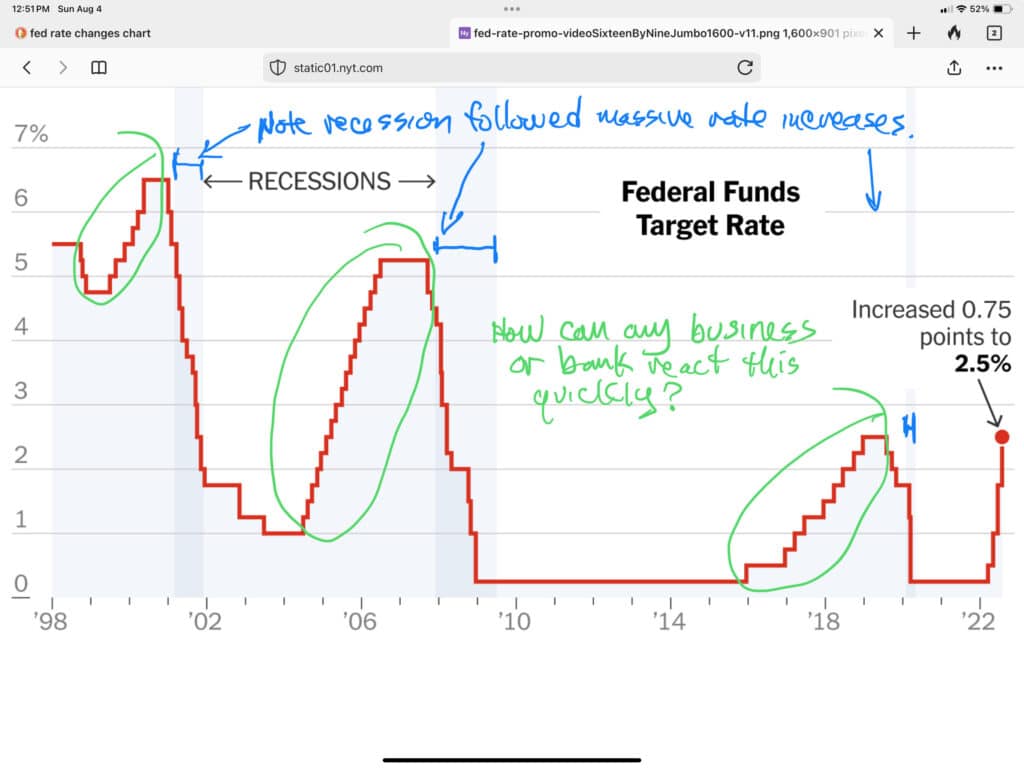

Second, this change to the decimal system would allow the Fed to start changing rates earlier than in the past, and move rates more slowly – which is critical to giving banks, businesses, and homeowners time to adjust and plan for the change. Look at the attached chart, as you can see, the Fed lets rates sit low for a long time and then rapidly raises them after they realize, oops, we have a problem Houston. The problem is that businesses, real estate developers, and banks can’t change their capital plans that fast. It takes years in this environment to get approvals on new buildings, expansions, and new products, and to adjust bank balance sheets in terms of their capital, and no one can keep up with this Fed.

But if the Fed were to have started increasing rates in smaller increments, sooner, over a longer period of time, not only would businesses have more time to adjust, but the likelihood is that the Fed would not have had to increase rates as high as they did. The massive increases were only needed in order to offset the late start on increasing, which let inflation get out of hand.

Third, with the Fed’s massive increases in rates, the taxpayers (the Federal government) is having to pay literally trillions of dollars more in total interest cost to feed the beast, i.e. fund the interest on the national debt. The Fed is quite literally bankrupting the country right before our eyes.

The answer is lower interest rates.

Some guy actually wrote into the Wall Street Journal that the Fed shouldn’t lower interest rates. What? Talk about a bonehead – or more likely, he’s talking his book. Talking your book is when Wall Street fat cats try to talk a stock or the Fed or some other organization into moving the stock (or interest rates) in the direction that the fat cat has placed a bet. It’s purely a self-centered verbal attempt to win big money through gambling on Wall Street. (The feds recently arrested a guy for doing exactly that.) So don’t listen to Wall Street.

I can’t think of any reason not to lower interest rates. Lower rates help reduce the interest the federal government pays on the national debt. Lower interest rates make paying back student loans easier. (Hmm, there’s a thought.) Lower interest rates make buying a house less expensive, and that’s good for democracy. Lower interest rates are good for business investment, good for developing new housing (single and multi-family), good for credit card payers, and good for everyone!

Inversely, keeping rates high is bad for everyone, bad for the economy, bad for banks that invested in Fed treasury bonds as a ‘safe investment’ only to see the feds come in and shut them down for having done exactly what the Fed and the feds told them to do. High rates are also going to cause a massive crash of the office building sector (when combined with higher vacancies) when it comes time for refinancing their loans, which will in turn cause financial difficulties at banks, insurance companies and even Fannie and Freddie. So why would we want to keep rates high?

Well, according to the Fed and that idiot Chairman Powell, higher rates are needed to bring down inflation. But inflation wasn’t caused by low rates, it was caused by the Fed printing 6 trillion of additional currency along with the Biden administration and their co-conspirators forcing businesses to close and remain closed for over a year causing a disruption in the manufacturing and supply chain. Of course, those morons don’t know anything about that.

Combine a supply chain shortage with flooding the market with $6 trillion and you have a textbook recipe for high inflation as too many dollars are chasing too few goods. What was needed was just the opposite. Don’t print the extra currency, and let the supply chain recover – and yes, even if there was a hick-up in the supply chain, it would be just that, a hick-up that would have gone away as more supply came online. But with the federal government getting into the game, i.e. sticking its nose into the demand side of this economic equation, the government started outbidding the private sector for goods and services (like road construction, construction materials, and labor). Stop the government from outbidding the private sector and inflation will come down as prices come down, just as lumber has recently come down substantially as supply and demand have leveled off.

This ain’t rocket science people. It’s farmer math. If you print too much money and give that to the government to compete with the private sector for goods and services during a period of disruption in the supply chain, you’re going to have massive price increases. Worse, no one and I mean no one has asked why the Fed thinks that inflation that is caused by the Fed and Biden is somehow going to go away by putting the squeeze on the private sector. Banks, businesses, and home owners should not be made to suffer or go broke just so that the Fed can wring inflation out of the economy. But of course, a real reduction in inflation can’t happen unless the Biden administration stops spending money like a drunken sailor and the Fed stops empowering the government by printing more money. Just stop printing more money.

The Fed could also step up its program of selling its bond portfolio because by selling bonds, it soaks up extra cash out there. In fact, the Fed could lower interest rates to help prevent a massive recession and also sell bonds to soak up extra investment capital to keep the stock market from forming another bubble. The Fed has to unwind its investment positions at some point…

Lastly, I would ask Congress to change the law so that the president could appoint a new Fed chair immediately upon taking office. Right now, the president has to wait one year before appointing a new chair, which means a whole year goes by before the president’s economic position and the Fed’s policies could become aligned, and then another year for those policies to kick in and have an effect. Why should a president be stuck with the loser chair that the prior president appointed who may hinder a desired economic turnaround?

So that’s my formula for success if I was Fed chair. Add in a few more little things like getting rid of pronouns, not relying on huge, long, overblown economic formulas, and instead relying more on a ‘man on the street’ perspective, i.e. asking businesses what they see happening on Main Street. If the Fed chair spent less time in Washington and more time in Main Street USA, he’d have a lot better understanding of what is happening in the economy and he would be able to better plan for interest rate changes (or not). Right now the Fed mostly uses economic models that are like trying to drive a car by looking in the rearview mirror. Instead, you need to be looking far ahead, like when I am driving – I’m looking as far ahead as I can see – for brake lights or other signals to what is happening ahead, and you can only do that by going out in the real world and talking to real people.

‘Nuff said.

Wisconsin Right Now is a news organization focused on covering the news from a conservative point of view, in particular on politics and policy issues through analysis and opinions, and is protected by the first amendment of the United States constitution. WRN does not make endorsements of candidates or direct readers to vote for or against any candidate or issue. On October 18 and November 23, 2023 Donald Trump tweeted out on Trump’s Truth Social account T. Wall’s October 6th column on Trump’s property valuations. T. Wall has appeared on Fox News, Jesse Waters Show on Fox, Newsmax, CBS, NBC, Spectrum News 1, USA Today, X.com, YouTube, and numerous Madison and Milwaukee news programs and local newspapers (Wisconsin State Journal, Capital Times, Middleton Review, Middleton Times Tribune, and Milwaukee Journal Sentinel and a dozen other Wisconsin papers) and previously wrote a column for InBusiness magazine and the Middleton Times Tribune for five years each. T. Wall holds a degree from the UW in economics and an M.S. in real estate analysis and valuation and his full time career is as a real estate developer. Disclaimer: The opinions of the writer are not necessarily those of this publication or the left!

![WATCH: Elon Musk Town Hall Rally in Green Bay [FULL Video]](https://www.wisconsinrightnow.com/wp-content/uploads/2022/04/Elon_Musk_3018710552-265x198.jpg)

![The Great American Company [Up Against the Wall]](https://www.wisconsinrightnow.com/wp-content/uploads/2025/03/MixCollage-29-Mar-2025-09-08-PM-4504-265x198.jpg)

![The Wisconsin DOJ’s ‘Unlawful’ Lawman [WRN Voices] josh kaul](https://www.wisconsinrightnow.com/wp-content/uploads/2025/03/MixCollage-29-Mar-2025-08-48-PM-2468-265x198.jpg)