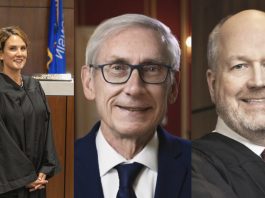

Here are 8 horrible things Tony Evers just did using his partial veto power in the state budget. From eliminating tax relief for the working poor and middle class to mandating that taxpayers continue funding gender transition surgeries, Evers had quite the day with the partial veto pen.

1. He eliminated tax relief for the working poor and middle class

Tony Evers right now: https://t.co/YxAIfOh6o2 pic.twitter.com/31NJAzWygq

— Rural California New Deal Fan🌹♻️🇺🇳🏗️🚃📚🚜🔰 (@RuralLeftie98) July 6, 2023

The media are making it sound like Republicans wanted to help the wealthy, and Evers is a crusader for the middle class. False. In fact, Republicans wanted to cut taxes for all taxpayers, whereas Evers slashed the Republican tax cuts for taxable income over $36,840 for married couples and for single filers’ earnings of more than $27,630.

Because those couples making 75000 a year are considered millionaires by the Evers administration

— PCB Patrick northern Wisconsin (@PCBPATJR) July 6, 2023

This strips tax relief from about 1.7 million Wisconsinites because Evers was upset that 11 wealthy people would also see tax relief (his words, not ours.)

2. He is putting taxpayers on the hook for gender transition surgeries, including possibly for minors

Holy mackerel, Governor Evers has now clearly demonstrated he doesn’t care about WI taxpayers. He clearly cares more about DEI and taxpayers paying for gender affirming care than middle class WI residents. Total priority fail! #wipolitics #wiright

— Repeal Wisconsin Min. Markup Law (@BadWILaws) July 5, 2023

Evers used his partial veto pen to ensure that Medicaid must continue to fund gender transition surgeries and puberty blockers, even, possibly, for minors. Read more about that veto here.

3. He is allowing schools to increase spending for 402 years

Govenor Evers veto has put state and property tax payers on the hook for more than $57 Billion in new K12 costs over the next 20 years assuming current enrollment trends continue. By 2043, we'd be on the hook for nearly $5 billion per year. pic.twitter.com/Y4ueWCIYOW

— Will Flanders (@WillFlandersWI) July 5, 2023

Evers eliminated a HYPHEN to allow school districts to add $325 per student every year for the next four centuries, unless a future Republican Legislature and governor undo it. He changed Republican wording referring to the 2023-24 and 2024-25 school years by vetoing a hyphen and the number “20” to change the passage to the year 2425.

Assembly Speaker Robin Vos says this change will result in massive property tax increases. It also disregards the obvious legislative intent with a deceptive veto.

4. He ignored the will of the voters on the “Frankenstein” and Vanna White vetoes

https://twitter.com/Sej_Singh/status/1676746311582773249

Voters have already spoken. They banned the use of the Frankenstein and Vanna White vetoes, whereby a governor could eliminate words or letters to change context in the state budget.

So he did it with a hyphen and numbers instead. Legal, sure, but this thwarts the obvious intent of the voters (as well as the Legislature). Really it’s a big middle finger in their faces.

5. He screwed over efforts to repair a northern Wisconsin fish hatchery

I want a governor who invests in Northern Wisconsin and does not forget their priorities. Read my full statement on what I had to say about Governor Evers signing the budget into law. ⬇️ pic.twitter.com/ZIYhAhRdC7

— Rep. Chanz Green (@ChanzGreen74) July 5, 2023

State Rep. Chanz Green (R-Grand View) wrote that Evers screwed over efforts to repair a fish hatchery in his northern Wisconsin district that is “operating at 30% capacity. The budget passed by Republicans would have provided millions of dollars to drill new wells, keep up with facility maintenance, renovate current buildings and construct new buildings. The governor vetoed this project just to keep the money in Madison.”

Evers’ budget message says the facilities are Les Voigt State Fish Hatchery near Lake Superior and the Brule State Fish Hatchery in Douglas County.

6. Evers retained 188 DEI positions in the UW System

Statement from @UWSystem after @GovEvers budget action restores 188 positions related to DEI:

"We thank Governor Evers…Supporting student success …will continue to be a priority of the UW System as we work with the Executive and Legislative branches."

— A.J. Bayatpour (@AJBayatpour) July 5, 2023

Evers wrote: “As a result of my partial veto, the UW System retains 188 positions related to diversity, equity, and inclusion at campuses across the state.”

Although we support more diversity on the UW campuses, the way to achieve that is by improving literacy and K-12 education, i.e. supporting school choice. The spending for these 188 positions would be better spent on workforce development and skills training to help students of all races get jobs by increasing the value of their degrees or on more financial aid for students.

7. Evers vetoed money for a charter school that helps the autistic

Evers vetoed grants to help the Lakeland STAR Academy, which is associated with the Lakeland UHS School District.

What is Lakeland Star Academy? “Lakeland STAR School/Academy is a charter school for autism in Wisconsin that caters to all diverse learners, not just students with autism spectrum disorder,” its website says.

8. Evers left the folks in the Town of Sanborn high and dry

Here’s what happened. According to the Ashland Daily Press, a federal court ruling declared 85% of the Town of Sanborn’s land tax-exempt by ruling that “Bad River tribal members who own property that was once sold to non-native tribal residents but has come back into tribal hands cannot be taxed under the 1854 treaty between the United States and the Ojibwe Nation.”

What happened as a result? The remaining 15% of property tax owners in the town of Sanborn had to pay the entire tax levy for the town themselves. The ruling has affected property taxpayers throughout northern Wisconsin, with some suddenly seeing tax hikes of 30%.

According to Ashland Daily Press, “As a result of the court’s decision, taxes have gone up from about $2,168 on a $100,000 property last year to $4,438 this year in Sanborn.”

What did Evers do? He vetoed a section prohibiting the Town of Sanborn from increasing property taxes even more.

His veto message says, “These sections include provisions that prohibit the town of Sanborn from imposing a property tax levy above five mills, prohibit the town from requesting a chargeback of property tax refunds issued by the town, and remove the town’s ability to use the levy limit debt service exclusion for debt service on general obligation bonds issued after July 1, 2005.”

He noted: “I am vetoing these sections because I object to such distinct and constraining limits on local control for one specific municipality in perpetuity. While I share the concern regarding impacts to local property taxpayers, this approach of restricting local control may unnecessarily hinder the town of Sanborn’s flexibility to address its own unique fiscal circumstances as well as unanticipated future expenses needed to maintain quality of service for the local community. These decisions are best left to local residents and town officials who know best how to balance the needs of their own community.

Table of Contents

![WATCH: Elon Musk Town Hall Rally in Green Bay [FULL Video]](https://www.wisconsinrightnow.com/wp-content/uploads/2022/04/Elon_Musk_3018710552-265x198.jpg)

![The Great American Company [Up Against the Wall]](https://www.wisconsinrightnow.com/wp-content/uploads/2025/03/MixCollage-29-Mar-2025-09-08-PM-4504-265x198.jpg)

![The Wisconsin DOJ’s ‘Unlawful’ Lawman [WRN Voices] josh kaul](https://www.wisconsinrightnow.com/wp-content/uploads/2025/03/MixCollage-29-Mar-2025-08-48-PM-2468-265x198.jpg)