The rapidly growing debt of the U.S. federal government has hit another milestone, topping more than $100,000 in debt per person.

While the U.S. population and the U.S. national debt are large numbers that are difficult to calculate, the rough debt estimate and rough population estimate end up at about $100,000 of federal debt per person in the U.S.

The U.S. Census population clock estimates the U.S. population at nearly 336 million. Meanwhile, the U.S. Treasury Department estimates the national debt is nearly $34 trillion.

“The national debt just exceeded $100,000 per citizen,” Rep. John James, R-Mich., wrote on X, formerly known as Twitter. “This should send a message to the White House that this reckless federal spending is at a breaking point.”

The U.S. Treasury confirmed in the middle of last month that in the first month of this fiscal year, the federal government had a deficit of $67 billion.

Concern about rising debt has grown along with the debt and recent international credit downgrades for the U.S.

The federal government received a credit downgrade from Fitch Ratings, one of the top international credit rating agencies in the world. The rating went from AAA to AA+.

Moody’s, one of the other top three credit rating groups, announced last week that it was lowering its evaluation of the U.S. credit from “stable” to “negative.”

The trust funds for Medicare, Social Security and highways are facing insolvency within a decade as the federal government borrows billions of dollars per day.

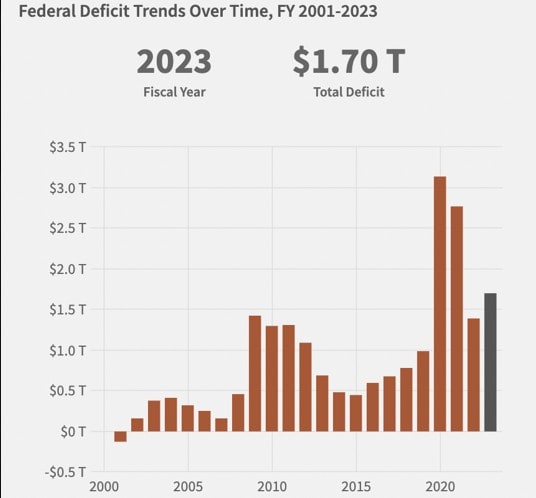

Despite these red flags, federal deficit spending, which has been elevated since the COVID-19 pandemic, Congressional spending shows little sign of slowing down. Deficits spiked during the pandemic, and while they have decreased from their COVID-era peaks, they still remain higher than before the pandemic.

This graph from the Treasury Department shows the trend:

Casey Harper

Go to Source

Reposted with permission

![WATCH: Elon Musk Town Hall Rally in Green Bay [FULL Video]](https://www.wisconsinrightnow.com/wp-content/uploads/2022/04/Elon_Musk_3018710552-265x198.jpg)

![The Great American Company [Up Against the Wall]](https://www.wisconsinrightnow.com/wp-content/uploads/2025/03/MixCollage-29-Mar-2025-09-08-PM-4504-265x198.jpg)

![The Wisconsin DOJ’s ‘Unlawful’ Lawman [WRN Voices] josh kaul](https://www.wisconsinrightnow.com/wp-content/uploads/2025/03/MixCollage-29-Mar-2025-08-48-PM-2468-265x198.jpg)