Wisconsin will send an estimated $1.56 billion to local governments in shared revenue in 2025.

That total includes $770 million for county and municipal aid, $281 million for supplemental county and municipal aid, nearly $174 million for Act 12 personal property aid, $98 million for exempt computer aid, $97 million for utility aid, nearly $76 million for personal property aid on locally assessed machinery and tools, $58 million in expenditure restraint incentive program aid and $10 million in video service cable provider aid.

The estimates include a $23.6 million increase in county and municipal aid based on last year’s sales tax collections.

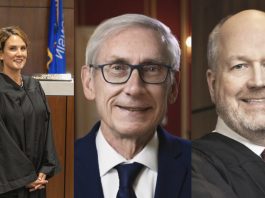

“I’m excited to see how the results of our historic shared revenue increases are going to help support communities and families across Wisconsin,” Wisconsin Gov. Tony Evers said. “We’re helping make sure our local communities can meet basic and unique needs alike, including investing in fire and emergency services, fixing local roads, expanding affordable housing and transportation, ensuring kids and families have clean and safe water and parks, supporting local public health and libraries—whatever those needs may be.”

The shared funds are mainly general, unrestricted aids that can be used for any activity approved by the local government.

The supplemental county and municipal aid cannot be used for administrative services and must be used for law enforcement, fire protection, emergency medical services, emergency response communications, public works, courts and transportation.

The Act 12 funds start in 2025 and are meant to compensate local governments for manufacturing personal property becoming tax exempt.

![WATCH: Elon Musk Town Hall Rally in Green Bay [FULL Video]](https://www.wisconsinrightnow.com/wp-content/uploads/2022/04/Elon_Musk_3018710552-265x198.jpg)

![The Great American Company [Up Against the Wall]](https://www.wisconsinrightnow.com/wp-content/uploads/2025/03/MixCollage-29-Mar-2025-09-08-PM-4504-265x198.jpg)

![The Wisconsin DOJ’s ‘Unlawful’ Lawman [WRN Voices] josh kaul](https://www.wisconsinrightnow.com/wp-content/uploads/2025/03/MixCollage-29-Mar-2025-08-48-PM-2468-265x198.jpg)