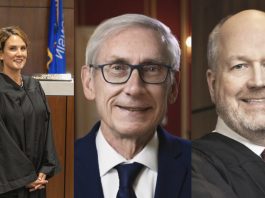

>(The Center Square) – The $4.4 billion tax cut plan approved by Republicans at the Wisconsin Capitol is the latest piece of the new state budget that Gov. Tony Evers is promising not to sign.

Republicans on Thursday okayed a tax cut package that will lower income taxes for everyone, but will give top earners in the state a larger tax cut.

“We are cutting income taxes by $3.5 billion and property taxes by $795 million, along with finally ending the personal property tax once and for all. The average taxpayer will see a $573 decrease in their state income taxes beginning in 2023,” Rep. Mark Born, R-Beaver Dam, and Sen. Howard Marklein, R-Spring Green said.

Gov. Evers wants a tax cut as well, but he has called the Republican’s previous tax cut suggestions a “tax cut for millionaires.”

He used a similar line about this tax cut proposal as well.

“Tax relief should be targeted to the middle class to give working families a little breathing room – not to give big breaks to millionaires and billionaires who don’t need the extra help to afford rising costs,” Evers said on Twitter. “That’s just common sense.”

The governor did not say Thursday if he planned to sign the tax cut plan, he has said in the past that he would veto any budget that cuts taxes for top earners.

Marklein acknowledged that is a possibility.

“But we made tax cuts last time, and the governor approved them, signed them into law, and ran on those tax cuts last fall,” Marklein added.

The Republican plan as written would cut Wisconsin’s top income tax rate of 7.65% to 6.5%, which means a 15% tax break for married couples making over $405,550 a-year. The same married couple making between $36,840 and $405,550 would see their income tax rate go from 5.3% to 4.4%, which is a 17% tax cut. Married couples who earn less than $36,840 would see their income tax rate go from 4.65% to 4.4%, which would be a 5% tax cut. Wisconsin’s lowest earners, a married couple who is making $18,420 or less, would see a .04% income tax cut, from 5.54% to 5.50%.

“These are good policies, and proper actions to return some of the surplus to the people of Wisconsin, and we hope that the governor agrees with that,” Born added.

The Republican tax cut is just one piece of the new state budget that has the governor promising a veto.

Gov. Evers has suggested he would veto any cuts to the University of Wisconsin, particularly those targeted at diversity, equity, and inclusion efforts at the school.

Lawmakers voted for $32 million in DEI cuts at the UW System on Thursday.

![WATCH: Elon Musk Town Hall Rally in Green Bay [FULL Video]](https://www.wisconsinrightnow.com/wp-content/uploads/2022/04/Elon_Musk_3018710552-265x198.jpg)

![The Great American Company [Up Against the Wall]](https://www.wisconsinrightnow.com/wp-content/uploads/2025/03/MixCollage-29-Mar-2025-09-08-PM-4504-265x198.jpg)

![The Wisconsin DOJ’s ‘Unlawful’ Lawman [WRN Voices] josh kaul](https://www.wisconsinrightnow.com/wp-content/uploads/2025/03/MixCollage-29-Mar-2025-08-48-PM-2468-265x198.jpg)