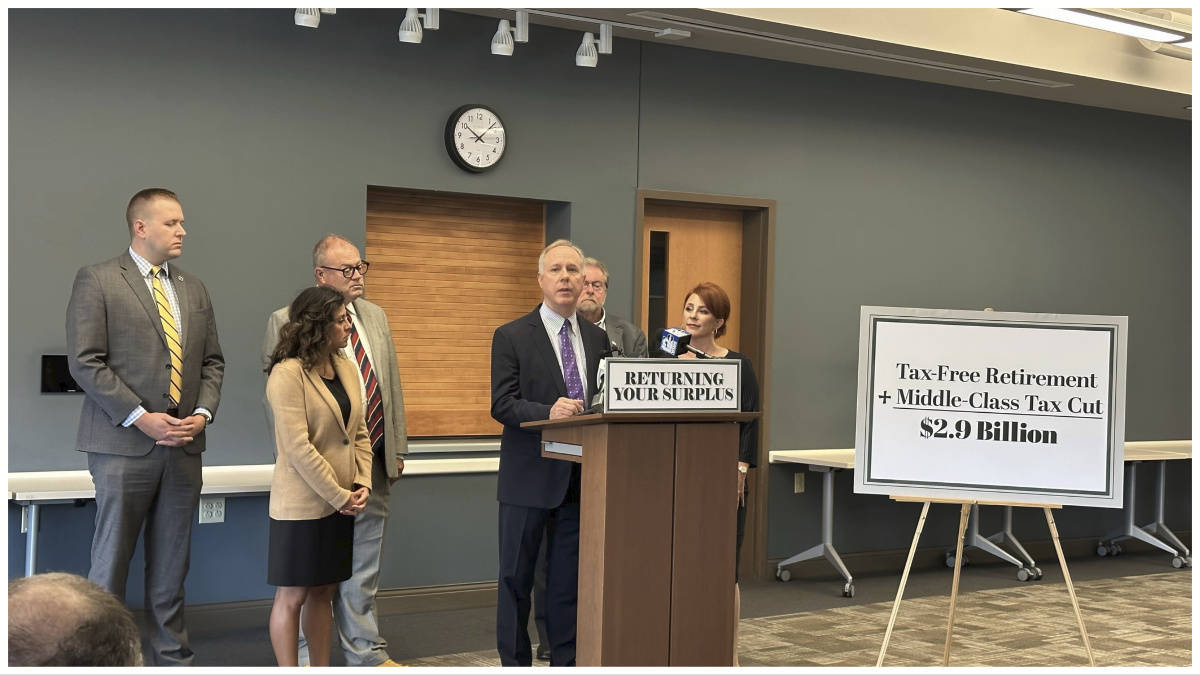

“It’s time for Governor Evers to fix his veto mistake and sign this middle-class tax cut” – Assembly Speaker Robin Vos

Speaker Robin Vos (R-Rochester) and Assembly Republicans announced the “Returning Your Surplus” proposal on Tuesday, saying it would “deliver major tax relief for Wisconsin’s middle-class earners and retirees. The proposal is expected to cut the state’s tax burden by nearly $3 billion, with an average filer seeing a savings of $772 a year.”

“With today’s crippling inflationary pressures, people have to dig deeper into their pockets,” Vos said in a press release. “Legislative Republicans are making good on our promise to return those dollars back to the hardworking people of Wisconsin.”

The “Returning Your Surplus” legislation “includes the creation of a Tax-Free Retirement as well as a middle-class tax cut to provide widespread relief,” a news release from Vos states. “In addition to exempting up to $150,000 in retirement account income for joint filers, this legislation would reduce the middle-income tax rate from 5.3% to 4.4%, helping the typical Wisconsin family, which makes an average of $67,000 a year.”

The release notes, “The proposal will next receive a public hearing before becoming available for consideration by the full Assembly.”

According to the AP, Evers has not commented on whether he will veto the income tax cut – again. The retirement savings are a new proposal. However, his spokeswoman Britt Cudaback tweeted a quote from a study that read, “State tax levels have little effect on whether and where people move — certainly not to a degree that should lead state policymakers to enact.” She also called it a “reckless tax plan.”

State Rep. Rick Gundrum (R-Slinger) said in a news release that Wisconsinites “are suffering from the pressures of inflation and a high tax burden in our state. This has made it challenging for many of Wisconsin’s families to afford everyday expenses.

That’s why I am working with my Republican colleagues on legislation to return our state’s surplus back to our middle class and fixed-income retirees.”

He added: “The tax relief package will reduce Wisconsin’s tax burden by $2.9 billion and save the average filer $772 each tax year. The middle-income tax rate will decrease from 5.3% to 4.4%. The average Wisconsin family makes $67,000 per year and lowering the income tax rate in the third bracket will help them make ends meet.”

According to Gundrum: “We are also supporting retirees by exempting up to $100,000 in retirement account income for single filers and $150,000 for joint filers. Under this proposal, Wisconsin residents who are 67 years of age or older will qualify for an income tax exemption on their retirement accounts. This will provide our retirees with meaningful savings to help cope with their rising costs.”

He added, “I am proud to support this tax relief plan for Wisconsinites. We must help them against inflation

right now.”

Assembly Majority Leader Tyler August (R-Lake Geneva) released the following statement on the GOP plan to reduce taxes in Wisconsin:

“Now that the state budget has been finalized and our priorities have been funded, the focus will be on what to do with the billions in surplus that still remain,” he said. “Our current surplus is the result of the taxpayers paying too much, rather than the government spending too little. Our goal is to get the surplus out of Madison and back into the pockets of its rightful owners: the taxpayers.”