Public schools in Wisconsin are getting more expensive in the latest round of property tax bills that are being mailed this month.

A new report from the Wisconsin Policy Forum says taxpayers will pay more than $78 million for K-12 schools on their latest property tax bills.

“Statewide K-12 property taxes will rise for the 11th-straight year,” the report notes.

The Policy Forum calls the $78 million increase “modest,” and says while people will be paying more in taxes, their tax rates will technically fall.

“This year, modest property tax increases for each of [the] four types of local governments will coincide with about a 14% increase in the value of property in the state – the highest single-year increase in recent memory.” the report explains. “So while many taxpayers will see higher bills (depending, in part, on whether their property has been reassessed this year), tax rates will decline because the value of property is increasing much faster.”

The four types of property taxes include Wisconsin’s school districts, counties, technical colleges, and special districts. The report does not look at taxes for cities, villages, and towns because the data on those won’t be available until early next year.

Wisconsin limits local tax increases as an attempt to lower the cost for taxpayers. But the report notes that many school districts have turned to voter-approved tax increases (referendum questions) to get around those limits.

“Since the beginning of 2018, voters around the state have approved 456 referendum questions – more than one per district. That includes 246 for operating budgets and 210 for borrowing for capital projects,” the report states. “Property tax levies increased 3.7% on December tax bills in those districts that have adopted referenda since 2020 while they fell 1.3% in districts that have not. In all, 285 of the 421 (67.7%) K-12 districts have passed at least one referendum in the last five years, with many passing more than one.”

Some of the biggest increases in local taxes have come in Wisconsin’s biggest school districts, Milwaukee and Madison, because of those voter-approved tax referendum questions.

“This year, Milwaukee Public Schools (MPS) will raise its levy by more than $14 million, an increase of 4.7% that is greater than the statewide average. The Madison Metropolitan School District (MMSD) is raising its levy by just under $6 million, or about 1.6% – just above average,” the report notes. “While not the sole cause, it is worth noting that in 2020, both of the state’s largest districts passed operating referenda to exceed levy limits with increases that ramped up over multiple years; MMSD also passed a debt referendum.”

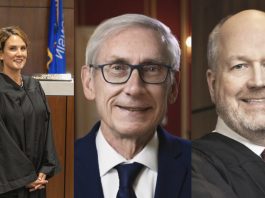

The report ends with a conclusion that lawmakers and Gov. Tony Evers have a decision to make on local school funding. The report recognizes that Wisconsin has a record $6.6 billion budget surplus, and questions how much of it can be used to keep property taxes in the state low.

You can read the Policy Forum’s report here.

![WATCH: Elon Musk Town Hall Rally in Green Bay [FULL Video]](https://www.wisconsinrightnow.com/wp-content/uploads/2022/04/Elon_Musk_3018710552-265x198.jpg)

![The Great American Company [Up Against the Wall]](https://www.wisconsinrightnow.com/wp-content/uploads/2025/03/MixCollage-29-Mar-2025-09-08-PM-4504-265x198.jpg)

![The Wisconsin DOJ’s ‘Unlawful’ Lawman [WRN Voices] josh kaul](https://www.wisconsinrightnow.com/wp-content/uploads/2025/03/MixCollage-29-Mar-2025-08-48-PM-2468-265x198.jpg)