Republicans at the Wisconsin Capitol are pointing to another report as proof their policies are working.

Senate Majority Leader Devin LeMahieu on Wednesday released a memo from the Legislative Fiscal Bureau that shows Wisconsin’s tax burden has fallen by $22 billion since 2011.

“In 2010, Wisconsin had the 5th highest tax burden in the nation. Residents were sending far too much of their earnings to Madison. On top of high taxes, the state had a $3.6 billion structural deficit, no Rainy Day Fund, and businesses were leaving in droves,” LeMahieu said.

Wisconsin is headed toward a record $4 billion surplus, plus a $1.7 billion rainy day fund.

“After twelve years of consistent tax cuts, fundamental reforms of government, and responsible budgeting, we’ve reduced the tax burden on Wisconsinites by $22 billion,” LeMahieu said. “As a result, our economy is more competitive and our state is attracting more people.”

Wisconsin’s Tax Burden

Wisconsin’s tax burden, according to the Wisconsin Policy Forum, was the fifth highest in the nation back in 2011. Now, the Policy Forum reports Wisconsin’s tax burden is the 23rd highest in the country.

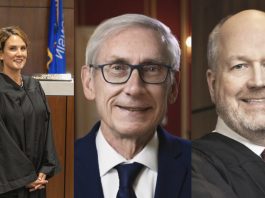

LeMahieu said none of the tax changes or savings would be possible if Gov. Evers had his way. He points to Gov. Evers’ first two budgets that would have raised taxes by over $1 billion, and increase state spending by up to $3 billion.

LeMahieu has expressed some support for using Wisconsin’s record surplus to lower or eliminate the state’s personal income tax.

He hinted at that again on Wednesday.

“The Legislature will continue our work to reduce the tax burden and the size of government so the people of Wisconsin can keep moving our state forward,” LeMahieu added.

Table of Contents

![WATCH: Elon Musk Town Hall Rally in Green Bay [FULL Video]](https://www.wisconsinrightnow.com/wp-content/uploads/2022/04/Elon_Musk_3018710552-265x198.jpg)

![The Great American Company [Up Against the Wall]](https://www.wisconsinrightnow.com/wp-content/uploads/2025/03/MixCollage-29-Mar-2025-09-08-PM-4504-265x198.jpg)

![The Wisconsin DOJ’s ‘Unlawful’ Lawman [WRN Voices] josh kaul](https://www.wisconsinrightnow.com/wp-content/uploads/2025/03/MixCollage-29-Mar-2025-08-48-PM-2468-265x198.jpg)